The high street bank has been a fixture of the British financial experience for generations, but a new wave of digital-only challengers is threatening to change that.

They have no branches, no paperwork, and a variety of features they hope will prise customers away from the incumbents.

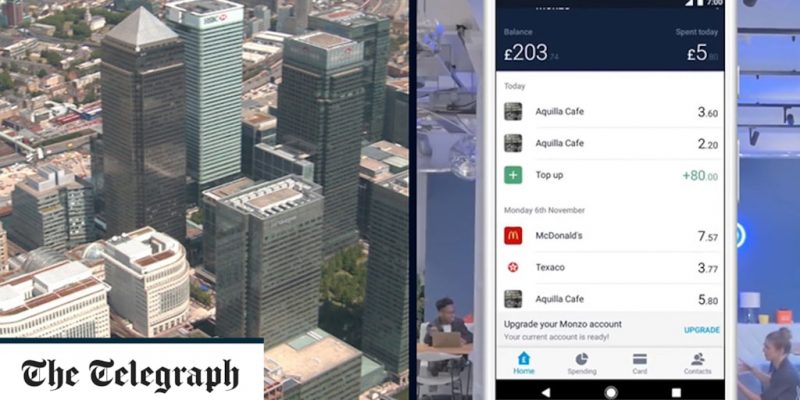

Of the best known, Monzo and Starling both offer full-blown current accounts, Atom Bank offers savings accounts and mortgages, Tandem shows all your accounts in one place and offers a credit card, and Revolut (which doesn’t have a banking licence) offers bill splitting, spending analysis and currency exchange, among other features.

Accounts can be set up and managed using a smartphone app, with no need to leave the house, talk to anyone or fill out a form.

Despite the hype, these challengers remain small compared to the established banks they are going up against – and the giants have enormous resources on hand to combat them.

Will the challengers be able to win lifelong customers from the high street, or will the behemoths’ vast spending power maintain their position at the top of the pile?

A major challenge is that high street bank customers have historically proven to be incredibly loyal, even when given little reason to be.

Tom Macdonald, of consultancy Deloitte, said: “You’re more likely to get divorced than change your bank. There is a legacy of trust – people don’t want to entrust their money to something they don’t know.”

In a recent survey of banking customers by research firm GFK, the average customer satisfaction level of the 16 banks included was 63pc. RBS and HSBC, two of the largest banks in the UK, had satisfaction levels of just 49pc and 55pc. Despite this, in the first half of this year, only 569,000 customers across all banks switched providers, according to payment company Bacs.

In 2012, RBS suffered a major computer glitch, causing mass problems and disruptions to millions of payments, but the number of customers it serves today remains broadly the same. The TSB scandal earlier this year proved to be a repeat, with few customers switching away so far.

Tom Blomfield, Monzo’s founder and chief executive, said: “When I was with a high street bank, it seemed like every experience was on a spectrum of pain. Monzo was born out of frustration.”

His ambition is not to replicate existing banks with Monzo’s own savings accounts, mortgages and other services. He wants to create a hub where customers can view and control all of their money in one place, with the accounts and services offered by third parties.

Credit:

Geoff Pugh

Ted Peeters, 26, was one of the first 5,000 people to open an account with Monzo when it launched in 2015. He had banked with NatWest, then used rival Starling as his main account, and only made the shift to handling his day-to-day finances with Monzo a few months ago.

“They just launched joint accounts, and my partner and I were looking to track our spending to save more efficiently for a house, which it does significantly better than any high street bank would,” he said.

“I don’t miss the human element, and think Monzo has done a great job with building trust through transparency.”

Monzo makes announcements on its blog to keep its users informed of any updates to its service, and lets them vote on a range of options for changes it plans to make. It also aims to avoid "big bang launches", testing new ideas on staff and small groups of customers before a wider roll-out to try and avoid a TSB-style meltdown.

Mr Peeters said that one area in which Monzo and its peers are lacking is in the financial incentives they can offer customers, such as vouchers for switching, free railcards for students and premier accounts with generous cashback.

On student accounts, Mr Blomfield said: "Banks are throwing hundreds of pounds at students, because it’s a point in life where you’re most likely to switch. So they just eat a ton of cost upfront. Unfortunately that’s just not a luxury we have."

Monzo expects to have opened 1.5 million current accounts by the end of the year – and the high street is not taking such rapid growth lying down. Many established banks have drastically improved their smartphone apps, offering fingerprint logins and voice recognition.

“I think the largest effect the new banks have achieved so far is to change the game of the incumbents,” Mr Macdonald said.

“They are still weighed down by legacy systems, but have changed their customer experience by improving the systems customers see.”

HSBC launched its Connected Money app earlier this year, becoming the first major bank to make use of Open Banking. The app lets its customers view all of their accounts across different banks in one place.

HSBC’s head of digital, Raman Bhatia, explained that the bank has been investing heavily to catch up with the newcomer banks.

He said: “The digital challenger banks have raised the bar on customer experience. What distinguishes HSBC is that we maintain a human element – the ability to walk in or call is always there.”

That remains an important attraction for many bank customers. Adisa Amanor-Wilks, 38, uses a number of high street banks, and has resisted family attempts to persuade her to use a digital alternative.

She said: “What happens if it crashes? There’s something about walking into a branch and speaking to a human being, but maybe I’m the old school type.”

For Mrs Amanor-Wilks, longevity and a historic relationship is what she values. For her to trust new services, she explained, they need longer track records.

“They just have to ride the tide, and be there for a while. They’re making all the noise, but they’re new, and for us to invest our livelihoods into their system, I want them to be around for a while,” she said.

Another challenge the digital banks face is that many of their users have opened an account to take advantage of one feature only, such as fee-free spending abroad – rather than switching over their full banking activities.

Mr Macdonald said: “It might not be their main banking service, so they don’t give up their existing bank account. It’s not just customer numbers that matter, it’s the share of their wallet.”

Yasmin Dick, 28, falls into this camp. She uses a Monzo card for holidays, but still uses HSBC for most of her day-to-day banking.

“I got a Monzo card after a bad experience with one of the high street banks, where I spent ages arguing over charges,” she said.

She explained that the sign up process, which involves taking a short video of yourself and taking a picture of identification documents, was in stark contrast to her recent experience opening an Isa.

"I got something in the post asking for original copies of documents, and for me to get documents validated. It was an online-only account, and the signature of the person I used to validate the documents doesn’t even look like his name. I couldn’t believe this was still how it worked," she said.

However, HSBC remains her mainstay as Monzo doesn’t offer everything she needs, and she still values human service.

“Monzo doesn’t offer anything in terms of savings, and I don’t track my spending in detail like some of my friends do,” she said.

Credit:

Jeff Gilbert

“I think HSBC’s app is really good, I’ve always had great customer service, and like having someone to call when something isn’t working.”

It takes a significant leap for customers to go from using a new bank for a single service to handing over their entire financial life.

A particular concern is that as new businesses, the likelihood of a 100pc success rate among the challengers is slim, meaning at some point one of them is likely to go bust. That would raise significant questions about public trust in the sector.

Mr Blomfield acknowledged the issue. He said: "What happens when inevitably one of these things fail? I think the Financial Services Compensation Scheme guarantee is a good start – people know they’ll get money up to £85,000 back within seven days. But potentially it causes a drop in trust. We’ll see – I’m not sure how we can act on that in advance."

Comments